Grimes County Texas Property Tax Rate . Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. Web every effort has been made to offer the most current and correct information possible on these pages. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web your local property tax database will be updated. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of.

from forttours.org

Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web every effort has been made to offer the most current and correct information possible on these pages. Web your local property tax database will be updated. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund.

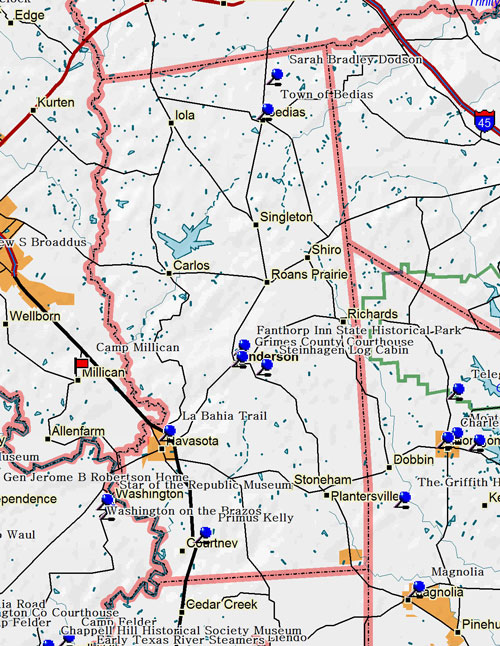

Fort Tours Grimes County Historical Markers

Grimes County Texas Property Tax Rate Web your local property tax database will be updated. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web your local property tax database will be updated. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. Web every effort has been made to offer the most current and correct information possible on these pages. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a.

From lidaymelisenda.pages.dev

Texas Tax Free Weekend April 2024 Freda Jillian Grimes County Texas Property Tax Rate Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web every effort has. Grimes County Texas Property Tax Rate.

From prorfety.blogspot.com

Travis County Property Tax Map PRORFETY Grimes County Texas Property Tax Rate This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web every effort has been made to offer the most current and correct information possible on these pages. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web an order establishing the tax rate. Grimes County Texas Property Tax Rate.

From www.cleveland.com

Property tax rates increase across Northeast Ohio Grimes County Texas Property Tax Rate The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web your local property tax database will be updated. Web the total county tax rate includes the general fund property tax rate, the. Grimes County Texas Property Tax Rate.

From byjoandco.com

Property Tax Rates in Katy TX Jo & Co. Not just your REALTOR®, your Grimes County Texas Property Tax Rate Web every effort has been made to offer the most current and correct information possible on these pages. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web your local property tax database will be updated. This property tax estimator is provided as a convenience to taxpayers and potential. Grimes County Texas Property Tax Rate.

From dorislwallxo.blob.core.windows.net

What Is The Property Tax Rate In Celina Texas Grimes County Texas Property Tax Rate Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web. Grimes County Texas Property Tax Rate.

From byjoandco.com

Property Tax Rates in The Woodlands TX Jo & Co. Not just your Grimes County Texas Property Tax Rate Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web. Grimes County Texas Property Tax Rate.

From forttours.org

Fort Tours Grimes County Historical Markers Grimes County Texas Property Tax Rate Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of.. Grimes County Texas Property Tax Rate.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide Grimes County Texas Property Tax Rate The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web an order establishing the. Grimes County Texas Property Tax Rate.

From austin.culturemap.com

Texas has the 6th highest real estate property taxes, new report finds Grimes County Texas Property Tax Rate Web your local property tax database will be updated. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web every effort has been made to offer the most current and. Grimes County Texas Property Tax Rate.

From kids.kiddle.co

Image Map of Texas highlighting Grimes County Grimes County Texas Property Tax Rate The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. Web your local property tax database will be updated. This property tax estimator is provided as a convenience to. Grimes County Texas Property Tax Rate.

From adrianawmabel.pages.dev

Property Tax In Texas 2024 Flori Jillane Grimes County Texas Property Tax Rate Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. This property tax estimator. Grimes County Texas Property Tax Rate.

From dorislwallxo.blob.core.windows.net

What Is The Property Tax Rate In Celina Texas Grimes County Texas Property Tax Rate Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web every effort has been made to offer the most current and correct information possible on these pages. Web all advalorem. Grimes County Texas Property Tax Rate.

From printablemapforyou.com

The Kiplinger Tax Map Guide To State Taxes, State Sales Texas Grimes County Texas Property Tax Rate Web your local property tax database will be updated. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web an order establishing the tax rate for grimes county for tax year 2020. Grimes County Texas Property Tax Rate.

From thecannononline.com

Reduce Texas’ Soaring Property Taxes by Embracing Sound Budgeting Grimes County Texas Property Tax Rate Web every effort has been made to offer the most current and correct information possible on these pages. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web your local property tax. Grimes County Texas Property Tax Rate.

From freeprintableaz.com

How High Are Property Taxes In Your State? Tax Foundation Texas Grimes County Texas Property Tax Rate This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. Web an order establishing the tax rate for grimes county for tax year 2020 whereas, the commissioners court of. Web all. Grimes County Texas Property Tax Rate.

From mavink.com

Texas County Tax Rates Map Grimes County Texas Property Tax Rate Web every effort has been made to offer the most current and correct information possible on these pages. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web your local. Grimes County Texas Property Tax Rate.

From helenebdanyette.pages.dev

Texas Property Tax Proposal 2024 Audie Marigold Grimes County Texas Property Tax Rate The median property tax (also known as real estate tax) in grimes county is $950.00 per year, based on a. Web the total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund. This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web. Grimes County Texas Property Tax Rate.

From prorfety.blogspot.com

PRORFETY Travis County Property Tax Map Grimes County Texas Property Tax Rate This property tax estimator is provided as a convenience to taxpayers and potential tax payers within the county. Web all advalorem taxes (property taxes) in grimes county are collected by the grimes county appraisal district. Web every effort has been made to offer the most current and correct information possible on these pages. Web an order establishing the tax rate. Grimes County Texas Property Tax Rate.